If your funds are available for distribution, you can request a rollover online from your employer-sponsored retirement plan through MyGuideStone®. GuideStone will not accept another institution's paperwork to transfer your retirement account.

Once logged in, follow the steps below:

1. Select the Retirement and Investments tab.

2. Click on the Withdrawals / Rollover Out link under Loans and Withdrawals.

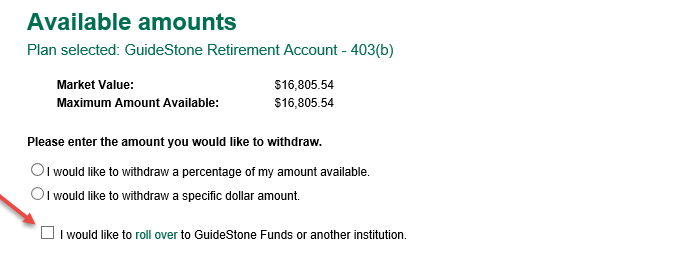

3. On the page that you select the amount to withdraw, check the box, "I would like to roll over to GuideStone Funds or another institution" and follow the next steps.

3. Complete the withdrawal application and then provide your electronic signature.

- If your outbound rollover application requires Spousal Consent, you must print the application and have your spouse's signature notarized.

- If your outbound rollover application requires Employer Verification, you must have an authorized official from your employer fully complete this section (or previous employer if separated from service). You are not permitted to complete this section yourself. An electronic signature is permissible for the Employer Verification section.

- Once you have obtained the required signature(s), use the Document Uploader to submit your application and receive the fastest possible service.

Note:

- This article is only for employer-sponsored plans such as a 403(b), 401(k), etc. To roll out your GuideStone Funds IRA, please contact us at 1-888-GS-FUNDS (888-473-8637).

- If you are unable to complete the request, please contact us. We'd be happy to assist you.

- If you have a Required Minimum Distribution (RMD) for the current year but have not yet satisfied the requirement, the tool will not display this option. You must first satisfy your RMD before rolling over. Click here for more information about RMDs.

If you no longer work for an institution affiliated with GuideStone, you can still contribute and have access to the same award-winning, Faith-based investing with a GuideStone IRA. You can also roll your existing retirement account to a GuideStone IRA. Click here to learn more about IRAs with GuideStone.