Within the year you are required to begin taking your RMD from your employer-sponsored plan, GuideStone will notify you by mail of the RMD amount and we will include the necessary form to request your distribution. We will also include the form to delay your RMD if you are still working. This will occur every year thereafter as long as RMDs are mandated for your account.

The IRS will require you to take a Required Minimum Distribution (RMD) from your employer-sponsored plan starting at age 73.

You can take your first distribution between January 1 and April 1 of the year following the year you reach your RMD age, but you must also take the second required distribution by December 31 of that year — resulting in two distributions in the same year.

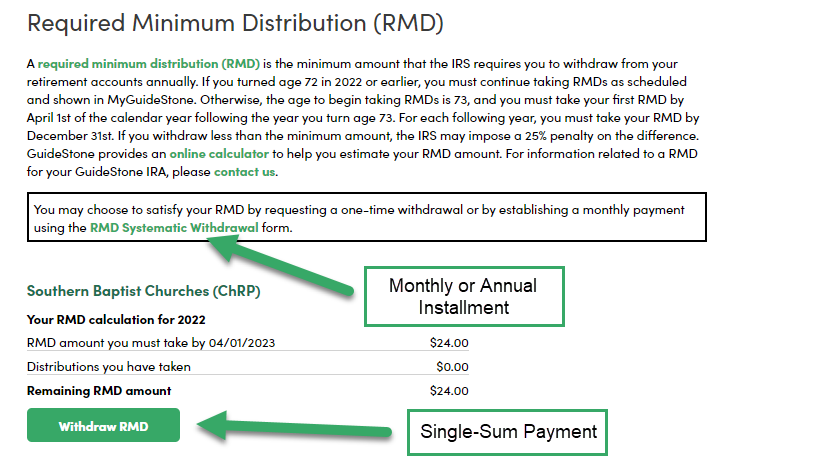

You can wait until you receive this notification from us or you can view this information online as soon as you reach your RMD age. You will be able to check your RMD amount and request to receive your RMD as:

a one-time payment. If you choose the one-time payment, you will have to request this each year after the new RMD amount has been calculated.

or set up a RMD systematic withdrawal plan through your MyGuideStone® account. If you set up the RMD systematic withdrawal, the RMD amount will be updated each year and will process at the same time and with the same elections as you request.

To access the withdrawal tool you must log in to your online MyGuideStone® account. Once logged in, you will find the withdrawal tool by following the steps below:

Step 1: Select the Retirement and Investments tab.

Step 2: Click on Required Minimum Distribution (RMD) under the Loans and Withdrawals tab.

Step 3:

3a. For single-sum withdrawals- Under your plan name, click "Withdraw RMD" to open the tool. You will be prompted to request your entire RMD as a lump sum and complete the online application.

3b. For systematic withdrawals - Complete and submit the online RMD Systematic Withdrawal form to establish a monthly or annual installment.

*If you establish a RMD Systematic Withdrawal, you are not required to complete a new application each year unless you decide to change your withdrawal plan. GuideStone is still required to notify you each year of your RMD, but the amount will automatically be distributed to you each year in the manner you requested on the form.

If you have not created a MyGuideStone™ account you will need to go to www.myguidestone.org, click on "Register now with MyGuideStone" and follow the steps for registration.

Note: If we do not receive a completed form or online request before the required deadline, we will force the distribution out automatically so that you do not incur a penalty from the government. The amount will be mailed to home address we have on file the deadline, GuideStone will withhold and send 10% of the RMD to the Internal Revenue Service on your behalf to be applied to your Federal Income tax liability. If you do not wish to withhold taxes from your RMD, you must complete the form or request your RMD online.

To learn more about RMDs, click here.